On Friday, SCOTUS ended President Biden’s landmark student debt relief plan

The decision was met with both praise and fury from both sides of the aisle

DailyMail.com scoured New York to find out what people REALLY think

READ MORE: What does the Supreme Court ruling on loans mean for YOU?

By WILL POTTER FOR DAILYMAIL.COM

The Supreme Court delivered another bombshell decision Friday to strike down President Joe Biden’s student debt forgiveness plan.

While the move saw the nation’s highest court finally settle the hot button issue, Americans remain sharply divided over whether or not they should foot the bill.

In New York, many students grumbled after feeling they missed out on a free degree, while Wall Street workers were relieved that their efforts to pay back their loans weren’t in vain.

‘I think student loan forgiveness is a double-sided coin,’ said Matthew Polo, 19. ‘For everyone receiving (the money), there will be another person who worked that much harder to paying off their loans.’

The landmark SCOTUS decision dashed Biden’s $400 billion plan to forgive $10,000 in debt for borrowers earning less than $125,000, and up to $20,00 for those with Pell Grants.

Matthew Polo, 19, described the issue of student loans as ‘a double sided coin’

From the iconic Washington Square Park down to the Financial District, DailyMail.com took to the streets of Manhattan to gauge reactions to the historic Supreme Court ruling.

For many New Yorkers, the judgement marked the end of their hopes to go debt free with the stroke of a pen.

However, others maintained it was the system that plunged students into insurmountable debt that should have been replaced, rather than the government paying off existing bills.

‘You have the taxpayers to consider in this,’ continued Matthew, a student speaking at the foot of the World Trade Center.

‘It’s difficult for those (who paid off their debts), because they spent so much time and energy doing that.

There is obviously a societal benefit to enabling people who would otherwise have been unable to get an education – I think it’s a matter of scale.

‘I don’t think there is a definitive answer, but as a student I have to continue to contemplate.’

Puja Mondal, 19, said she hopes a new plan will be introduced to help other struggling students

Thanks to a COVID pandemic freeze, millions of Americans haven’t had to repay their loans for over three-and-a-half-years.

But with borrowers restarting their payments in October, and interest starting in September, students feel they just missed out.

‘For me as a student who does receive loans, I can understand the people that are low-income minority, and who needs this additional support for education,’ added Matthew’s friend Puja Mondal, 19.

‘The student loan forgiveness program should exist, it helps a lot of students like me and my family and friends who are going through college to give them a great opportunity for their career.

‘I think if you’re going to end this program, you should have a replacement for those who still go to college and need the help.

‘But I definitely think that refunds should exist,’ she added. ‘But it is a double-sided coin, there are pros and cons, and it’s something that has to be talked out to become better.’

One recent graduate and teacher admitted she was ‘looking forward’ to the loan forgiveness, but felt refunds were appropriate for repayments

One recent graduate, who did not give her name but said she recently became a teacher with her degree, admitted she had been ‘looking forward to getting some sort of forgiveness’ on her loans.

‘The extra money would have helped,’ she said, adding that she works through a plan to pay off her loans bit by bit. After personally trying to pay her debts, watching others get them wiped for free would make her ‘upset’.

‘I would understand why other people would be upset,’ she continued. ‘I think some form of refund, some sort of reimbursement, would be nice.’

Her fellow graduate, who said he got by on scholarships, added that student loan forgiveness may be necessary at this moment because of America’s floundering economy.

He added: ‘People need help right now, schooling is really expensive and its something they should look into – both lowering student debt in general, and helping people out.’

Shane Morgan, 41, said he would ‘deep down feel resentment’ if he paid his loans before others had them wiped clean for free

Shane Morgan, 41, speaking from Manhattan’s Financial District, said if he paid off his debts when others had them wiped for free, he would ‘deep down feel resentment’.

However, despite saying he would feel some bitterness if he paid his loans while others didn’t, Shane felt approving the plan would have some upsides.

‘It would help the greater economy as a whole,’ he said. ‘It will keep people out of debt, which will result in more spending and a better economy for everybody.’

As a Canadian, Shane admitted he ‘doesn’t have skin in the game’, but argued that the slate of decisions to come out of the Supreme Court since it turned to a 6-3 conservative supermajority meant it had ‘lost legitimacy’.

‘The Supreme Court used to be the gold standard of judgement, but now I feel it is too partisan and political’ he added.

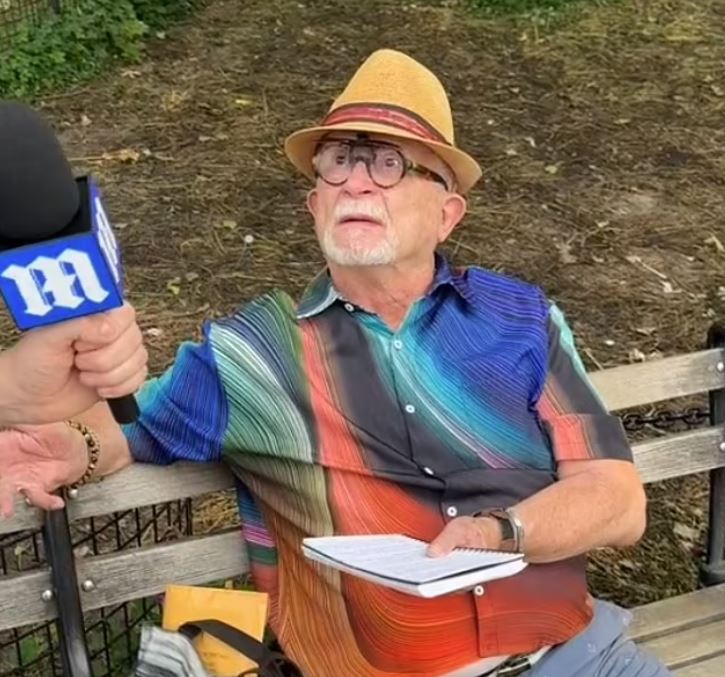

Bruce Harrow hit out at the for-profit college system, feeling that ‘we just shouldn’t have students coming out of school with thousands and thousands of dollars in debt’

One University of Pittsburgh graduate slammed the Supreme Court for its decisions since it became a conservative supermajority.

He added that even if he had committed thousands to repayments, he wouldn’t feel any spite, as ‘just because you didn’t benefit from something good, doesn’t mean that other people can’t.’

Speaking from New York’s Washington Square Park, Bruce Harrow slammed the system that leaves students in massive debt, which in turn threatens taxpayers with having to foot the bill instead.

‘We just shouldn’t have students coming out of school with thousands and thousands of dollars in debt, it’s just ridiculous,’ he added.

He said he personally knows people shackled with $100,000 in debt, but felt repayments shouldn’t be reimbursed because ‘it’s water under the bridge’.

The Supreme Court has struck down President Joe Biden’s $400 billion student loans forgiveness plan in another bombshell decision. The justices ruled 6-3 against Biden’s controversial plan to wipe out debts for around 20 million Americans

Joe Biden’s student loan forgiveness scheme had been held up in a legal battle since November

The opinions came as the Supreme Court made a series of decisive conservative-favored decisions as it entered the final day of its term.

Alongside student loan forgiveness, the justices, which are slanted 6-3 in favor of conservative judges, also struck down historic affirmative action policies.

The decision effectively ended college’s being able to use race as a consideration in admissions, in a case that sparked backlash from Biden.

For student loan forgiveness, Biden’s plan would have eradicated $10,000 in debt for borrowers earning less than $125,000 and up to $20,000 for those with Pell Grants.

His plan would have cost taxpayers $400 billion, but it has spent months weaving through the legal system after being initially halted in November.

The move was challenged by six Republican states and two borrowers, who argued Biden should have sought approval from Congress for a plan using substantial taxpayer funds.

In his majority opinion, Chief Justice John Roberts agreed and said the action ‘requires that Congress speak clearly before a Department (of Education) Secretary can unilaterally alter large sections of the American economy.’